Most people feel financial stress quickly after losing a job. Bills keep coming while income stops, creating a tough spot for many families. This sudden change forces hard choices about which costs to cover first.

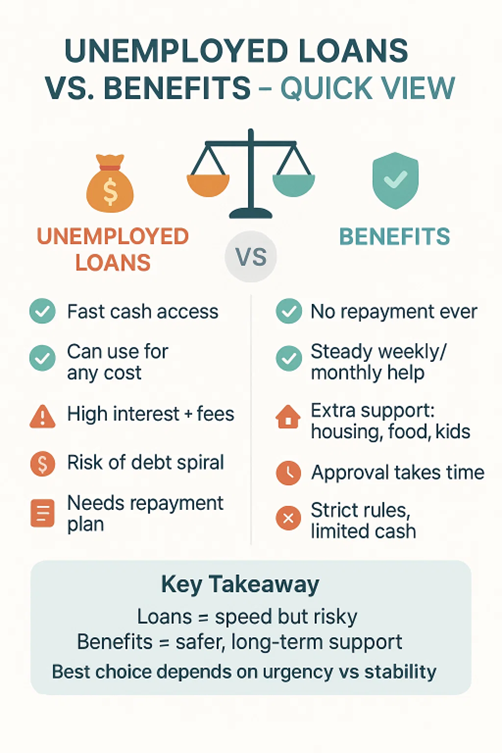

Loans offer a faster way to bridge financial gaps while searching for new employment. The cash can help cover bills until your first pay from a new job arrives. This choice means taking on debt during an already tough time. The weight of new monthly payments adds pressure to find work quickly. Many weigh this stress against the need to pay bills and keep food on the table.

What Are Unemployed Loans?

Losing your job puts a huge strain on your money situation almost right away. The bills keep coming, but your income suddenly stops, creating a tough spot that needs quick fixing. Unemployed loans offer cash when you have no job, but the terms often come with much higher costs than regular loans. Most lenders see people without jobs as risky, so they charge more to cover their chance of not getting paid back.

| Loan Type | Average APR % | Notes |

| Personal Loan | 6% – 12% | Depends on credit score |

| Payday Loan | 800%+ APR | Very high, short-term only |

| Credit Card (Purchase) | 20% – 35% | Higher if poor credit |

| Overdraft (arranged) | 20% – 40% | Daily fees may apply |

| Guarantor Loan | 30% – 60% | Needs a co-signer |

Pros of Loans

The biggest plus of loans during jobless times is the speed of getting cash. When your rent is due next week but your first benefit payment won’t come for a month, loans bridge that gap. The online process for many of these loans works quickly, often with money in your account the same day you apply. This fast help lets you keep the lights on and food in the kitchen while you sort out longer-term plans.

Loans for the unemployed with bad credit help when state support isn’t enough or comes too slowly. These no guarantor loans focus on your current situation rather than your past job history. Direct lenders make the whole process simpler since you work with just one company instead of going through agents. The focus on today’s needs rather than yesterday’s credit mistakes opens doors for people in tough spots who need help right now.

Cons of Loans

Taking loans without a steady work income carries real risks that can make bad situations worse. The costs run much higher than regular loans, with some short-term options charging hundreds in interest over just a few months. These high costs mean paying back much more than you borrowed. The strain of these payments gets heavier each month you stay without work, creating a cycle that’s hard to break.

What Are the Benefits?

If you become unemployed in the UK, then the benefit system will provide you with financial assistance. These government payments will allow you to purchase food and cover your living arrangements without entering debt.

Universal Credit rolls out nearly all of this assistance into a single payment, but this can be significantly different depending on your case. Your age, rent/mortgage rates, whether you have any children, and whether you have any savings will impact how much monthly financial assistance you receive.

The trade-off for this help comes in following certain rules that can sometimes feel like a part-time job themselves. You’ll need to prove you’re actively hunting for work through regular check-ins and keeping logs of your applications.

The whole point is temporary support while you get back on your feet. Miss those job centre meetings or application targets, and you might find your payments at risk.

| Loan Type | Interest Rate | Repay Time | Key Point |

| Budgeting Loan (income support) | 0% APR | Up to 2 years | No interest, repay direct from benefits |

| Budgeting Advance (UC claimants) | 0% APR | 1–2 years | Taken from future UC payments |

| Crisis Loan (discontinued) | — | — | Now replaced by other schemes |

Pros of Benefits

The real benefit is receiving assistance without having to worry about debt in the future. Benefits often bring extra help that goes beyond just cash in your account. Your rent might be partially or fully covered when you’re between jobs. Council tax bills can drop significantly when your income does. All these extras form a wider safety net that cash alone couldn’t provide.

- No repayments to worry about down the road

- Regular money, you can plan around each month

- Help with keeping your housing situation stable

- Support for other costs like school meals and medicine

- Access to job search help and skills training

- Emergency payments for unexpected crises

Cons of Benefits

The wait for benefits causes real headaches for many people. With Universal Credit taking five weeks before the first payment lands, that gap leaves many choosing between heating and eating. This delay forces tough calls about which bills to pay and which to let slide. While advance payments can help bridge this gap, they’re borrowing from your future benefits.

Considering Loan Options

Personal loans offer fast cash but come with risks during times without work. Most regular banks turn down loan requests from people without a steady income. Their rules require proof that you can make the monthly payments.

If you are on benefits and need a loan today, then direct lender bad credit loans are available to help people like you. These lending options look at other income sources beyond just jobs. Theseloans typically cost more through higher interest rates due to the added risk.

The right choice between loans and benefits depends on your full situation. Short job gaps might make a small loan work well as a bridge to your next pay. Longer times without work often make benefits the better path despite the wait.

Conclusion

The amount you receive depends on many factors about your life. Your age, housing costs, children, and savings all affect what you get each month. The first payment often takes five weeks to reach you after approval. This waiting time causes problems for many who need help right away. Some can get advance payments, but these come as loans you repay from future benefits.

Jessica Rodz is the Senior Content Writer at Cashfacts. She has a long career in the field of content writing and editing. Jessica has the expertise in the UK lending marketplace where she has worked with 7 different lending organisations and acquired many responsibilities from preparing loan deals and writing blogs for their websites.

At Cashfacts, Jessica is managing a team of experienced loan experts and doing a major contribution in guiding the loan seekers via well-researched blogs. She has done graduation in Business (Finance) and now currently doing research papers on the UK financial sector.