Customised installment loans to borrow up to £10000

Are you looking to acquire immediate cash for your financial needs but prefer to pay back the amount in instalments? You are in the right place. Whether it is financial hiccups or unforeseen troubles, installment loans help to tackle all your problems with flawless solutions. You can return the amount in convenient instalments. This will reduce your financial problems and cut the complications.

You can use personal installment loans for any purpose. In most cases, people prefer to get these loans due to the following reasons:

- To pay for urgent home repairs or home improvements

- To sort out some cash flow problem

- To buy a vehicle or repair a car

- To cover family travel expenses, etc.

If you find yourself short on money for unexpected costs, check out CashFacts for some extra cash needs. You can easily borrow a specific amount with a simple settlement schedule. It means you are back in control.

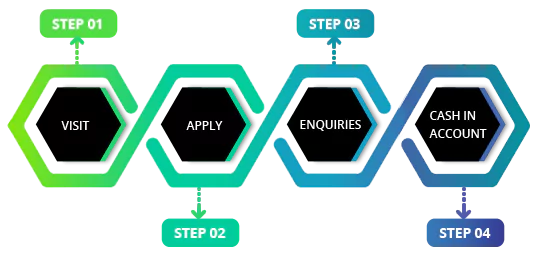

There is no need to stress about repaying everything at once. You can handle your finances one payment at a time by choosing our deal. Do you need help with money challenges or wondering how to get installment loans near me? Turn to us, and we will be with you every step of the way.

What is an installment loan and its advantages?

These loans can be obtainable in times of emergency, which you pay back in a certain period, along with the charges. In most cases, monthly payments are fixed. Sometimes, you can also get weekly installment loans in the UK when you borrow smaller amounts. These are accessible with the terms like 6 months and 12 months.

You can use the loan amount for personal, lifestyle, and business needs. Yet, you must repay the loan and interest in handy instalments. Usually, these kinds of loans are flexible because you will receive a large sum upfront, and then you need to settle the amount in small repayments. First of all, this also helps you manage cash flow.

Getting these personal loans from direct lenders offers a lot of ADVANTAGES. It even becomes the practical choice for people needing financial support.

Spread repayment: Getting quick loans gives you more flexibility. With this, you will receive the money that you need. Usually, it will vary from several months to years.

-

Cash flow management: Unlike any other traditional loan with a short settlement time, you will get installment loans online with an extended repayment period. You can quickly get free from financial pressures with a manageable cash flow.

-

Early repayment: When you can repay the total amount early, it is also best to avoid complications. Through this process, you can easily experience less burden on your interest. Most importantly, you do not have to pay any penalty to pre-pay loans.

-

Varieties of loan types are available: Typically, several kinds of loans are available in weekly or monthly instalments.

-

Loans for debt consolidation – Merge several debts into one monthly repayment. Bid adieu to past pending payouts at one go with debt consolidation loans.

-

Bad credit loan – Anyone struggling hard with poor credit scores can apply for bad credit instalment loans. Repay in small amounts, i.e., a portion of the total amount over months.

-

Personal loans – Depending on whether or not you can pledge collateral, you can choose between unsecured and secured loans. The amount, term, and rate will vary accordingly.