Getting access to loans without involving a third entity in the loan ensures peace and privacy. Most SMEs prefer fast loans without a guarantor to meet their needs quickly.

It is because such a loan eliminates detailed documentation, cumbersome assessments, and gets the loan the same day. It proves beneficial especially in sensitive business requirements like closing a business deal with advance. Here, a small business loan may help you get one quickly.

The blog discusses fast loans with no guarantor and how you may qualify as a business or individual.

Fast loans with no Guarantor: How does it work?

Fast loans without a guarantor are loans that one can get without involving a third person or entity. It is possible to qualify for such a loan only if one can afford the repayments comfortably. The person must meet the credit and financial requirements to get a loan. Here, the borrower is solely responsible for the loan repayments.

Such loans share high risks for the loan companies, and hence the interest rates remain competitive. One may get it the same day without too many complications and assessments. These are highly unsecured loans that one may get without risking precious business assets.

How does it work: The process?

- Step 1– You can apply for fast loans with no guarantor in the UK online by providing basic business and personal details.

- Step 2-The loan provider evaluates your creditworthiness and affordability by verifying your details against a set standard.

- Step 3– You may qualify if you can afford a loan amount without affecting other important business payments

- Step 4– if approved, you may get funds within a week, according to the respective loan company’s personal assessment process

- Step 5– You must repay the dues in easy instalments after getting the loan. You can also set direct debits.

What makes a Fast business loan different?

Yes, a quick business loan is different from the traditional ones. Here is how:

| Criteria | Fast business loans | Traditional business loans |

| Speed of funding | 1-3 business days | 2-8 weeks |

| Application process | Online, less documentation | Full business plan + financials |

| Common terms | 3-12 months | 3-5 years |

| Approval criteria | Revenue-based, turnover-driven | Profitability+ collateral |

| Interest and fees | Higher APR, fee loaded | Lower APR, fewer fees |

| Criteria | Fast loans | Traditional personal loans |

| Speed of funding | Often happens the same day, within minutes to hours | May take 2-5 business days |

| Application process | Entirely online, soft credit check that does not affect credit score | May require detailed documentation, and credit checks may be detailed and affect the credit score temporarily |

| Common terms | 3-36 months (often 3-12months) | 12- 60 months |

| Approval criteria | Based on current income, affordability and credit history, no co-signer or guarantor is required. | Based on current income, credit score, employment history and overall credit history |

| Interest and fees | High interest rates due to no collateral or guarantor involved. (up to 1721%) APR | The interest rates generally remain less than fast loans (5.8%) from responsible providers. |

Understanding the clear difference helps you choose the right loan for your needs. If the loan helps with quick revenue growth in weeks, a fast loan is ideal. If it may take 5 years or more, you can consider a traditional loan.

What are the advantages of quick loans without a guarantor?

Here are the pros of fast loans without a guarantor for SMEs and individuals:

Advantages of fast loans without guarantors for business owners:

- Supports growth without tying up personal contacts into a liability

- Fast approval supports urgent business needs like payroll, marketing, and inventory updates

- Streamlined digital application reduces paperwork and guarantor-based assessments

- Responsible repayments strengthen the company’s business credit history and boost its credit score.

- One can use the funds for unique business requirements without risking tangible assets like business property.

Advantages of fast loans without guarantors for business owners:

- Safeguards personal relationships without involving any family member in the loan.

- Help one access instant cash for medical needs, car repair, or paying urgent bills like rent

- Requires minimal documentation, as approval is based on income and affordability instead of a guarantor

- Timely repayments help improve personal credit score. It eventually paves the way for cheaper credit in the future

- Individuals don’t lose their personal assets if they default or cannot pay the loan. However, the credit score and financials may get problematic for some time.

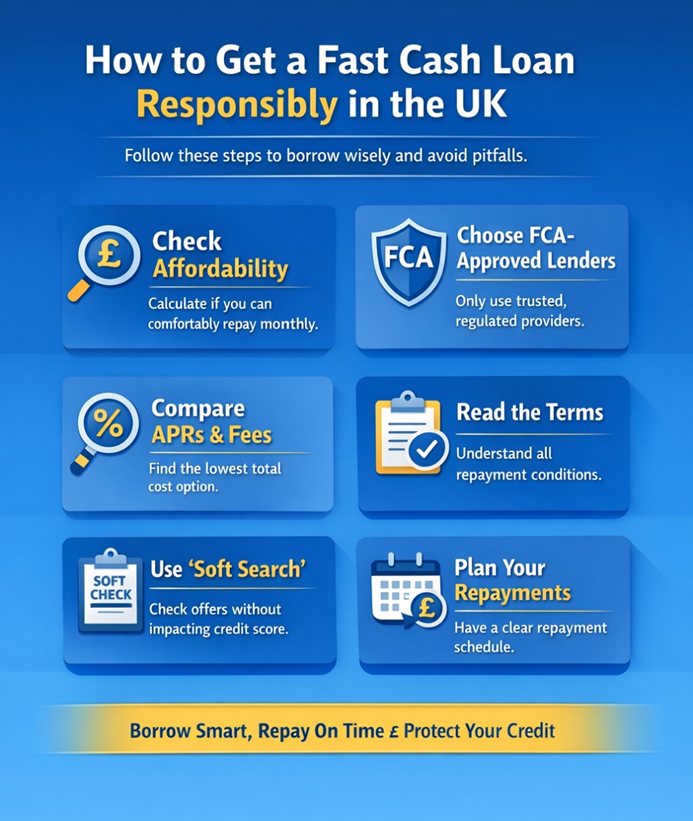

What to consider before getting a loan without a guarantor?

Here are some things to consider before getting a loan from a direct lender with no guarantor for business and personal needs:

| Cautions for SMEs | Cautions for Individuals |

| Analyse whether you can carry business payments alongside the loan repayments well. | Confirm that the repayments are within the monthly disposable income that you are left with after meeting essential costs. |

| No guarantor loans can prove expensive than business loans. Thus, analyse the total repayable amount, not just the headline rate. | APRs are higher for mainstream personal loans. Compare the total repayable amount, including fees, not just the monthly instalments to make. |

| Always use the loan for an urgent matter, which may help your business grow. Don’t always use it to pay for debts. | Use the loan only for critical emergencies at hand that you cannot meet with savings. Don’t use it for discretionary things. |

| You should always check the loan agreement to see whether it includes any guarantor clause or cross-default provision. | Ensure clarity over loan terms and make sure that the loan does not turn into a rollover. Plan the repayments well. |

When is a fast loan a great fit for business and individuals?

Here are the circumstances under which a fast loan proves suitable for your business and individual requirements:

Tap a fast loan as a business owner if:

- You need immediate funding to cover short-term cash gaps

- Needs temporary working capital and expects revenue soon

- Seize time-sensitive business opportunities

- You do not want to risk business or personal assets

- May not meet the traditional criteria or hold a low business credit score

Similarly, you can check a fast loan without a guarantor as an individual if:

- You need to cover unexpected or unplanned expenses

- You need a loan for a short duration and can repay it quickly

- Helpful in closing a time-based aspect, like booking a travel ticket

- Struggle to qualify elsewhere due to limited credit history

- Does not want to involve friends and family as a guarantor

FAQs

- When should you avoid a quick loan as a business owner?

You should avoid a fast loan as a business owner in the following circumstances:

- You need money for expansion or long-term projects

- You are not confident about repayments

- You rely on short-term credits often and apply due to the ease of approval

- Making a large-scale purchase

- Is it possible to get a fast loan with bad credit?

Yes, individuals and businesses may get a quick loan despite a bad credit history. You may get the loan approval if you share the potential to repay the dues on time. It is because approval is mainly based on current income and affordability.

- How to prepare before applying as a business owner?

You need to prepare by ensuring the following:

- Forecast your cash flow and check how much you can afford to borrow

- Collect the latest documents

- Understand the basic costs that you may encounter on loans by pre-qualifying

- Review the total loan amount to pay

- Analyse aspects that may help you fetch a lower interest rate.

- What happens if I miss a payment?

Missing payments may result in late fees, increased interest costs and a negative credit impression. Contact the creditor immediately if you struggle to pay the dues.

Jessica Rodz is the Senior Content Writer at Cashfacts. She has a long career in the field of content writing and editing. Jessica has the expertise in the UK lending marketplace where she has worked with 7 different lending organisations and acquired many responsibilities from preparing loan deals and writing blogs for their websites.

At Cashfacts, Jessica is managing a team of experienced loan experts and doing a major contribution in guiding the loan seekers via well-researched blogs. She has done graduation in Business (Finance) and now currently doing research papers on the UK financial sector.