The final month of the year brings many costs for most UK households. Gifts for family and friends form a large chunk of the December budget. Food costs rise when planning for holiday meals and hosting extra guests.

The gap between available funds and needed cash can cause real stress. Some people dip into savings, while others consider temporary borrowing options.

Short-Term Loans

The best loan schedules align perfectly with your upcoming paydays. Your budget must include these repayments alongside regular January expenses. The holiday joy fades quickly when repayment problems start in the new year.

A short-term loan from a direct lender can provide fast funds with no credit check when traditional banks say no. These specialist lenders focus more on your current income than past issues. The application process skips lengthy credit history reviews, which often delays decisions.

Short-Term Loans for December

Quick approval becomes essential as the December shopping deadlines approach. Many lenders now offer same-day decisions on smaller loan amounts.

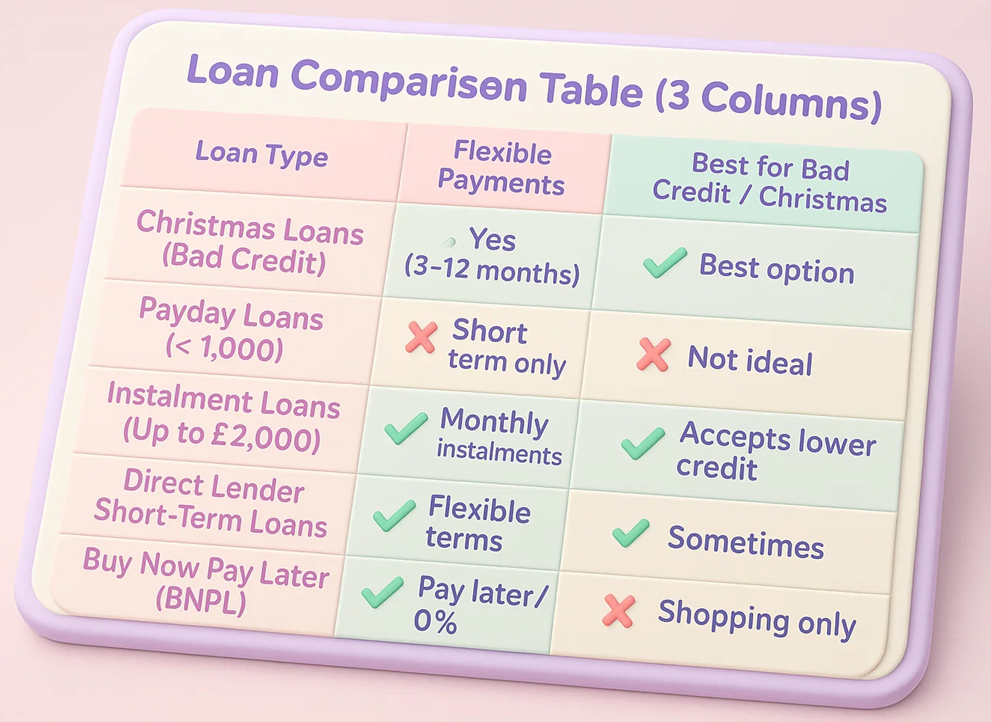

Here are the best loans you can apply for:

Payday Loans (Under £1000)

Payday loans work best for covering small gaps in your December budget. These loans typically range from £100 to £1000, depending on your income level. You can usually apply online and see money in your account the same day. The main feature is their short-term nature, with repayment due when your next paycheck arrives.

| Feature / Term | Typical Range (UK) | What It Means for You |

| Loan Amount | £100 – £1,000 | Quick funds for short-term cash gaps |

| Repayment Period | 1–3 months | Faster payoff, less long-term commitment |

| Representative APR | 600% – 1,300%+ | Costly, but immediate access to cash |

| Speed of Payout | Same day or within hours | Money arrives fast when urgent |

The main advantage of payday loans is their speed and ease of access. You won’t face lengthy credit checks that delay getting the cash you need. The entire process takes just a few hours from application to money in your bank.

- Your funds arrive quickly, often within hours of approval

- The loan gets repaid in one lump sum on your next payday

- You can typically borrow between £100-£1000 based on income

- The process works well for urgent Christmas shopping needs

Instalment Loans (Up to £2000)

The monthly payments are smaller and more budget-friendly than those for payday loans. Your repayment dates are fixed when you take out the loan, enabling precise planning. These loans work better for larger Christmas expenses, such as family gifts or holiday travel.

| Feature / Term | Typical Range (UK) | What It Means for You |

| Loan Amount | £500 – £2,000 | Larger borrowing for planned needs |

| Repayment Period | 3–18 months | Spread the cost into manageable instalments |

| Representative APR | 39% – 99% | Lower than payday loans, flexible |

| Monthly Instalments | Fixed | Predictable payments, easier budgeting |

- The repayments are spread across 3-12 months in equal instalments

- Your monthly payments stay affordable and easy to budget

- The interest rates usually run lower than single-payment payday loans

- You can plan for big purchases like family gifts or holiday travel

Christmas Loans for Bad Credit

Bad credit scores block many people from getting help during the expensive holiday season. Your past financial mistakes can follow you for years on your credit reports. The big banks often reject applications based solely on credit scores. Poor credit history doesn’t always reflect your current ability to repay loans.

| Feature / Term | Typical Range (UK) | What It Means for You |

| Loan Amount | £300 – £2,000 | Helps cover festive expenses & gifts |

| Repayment Period | 3–12 months | Spread cost beyond December |

| Representative APR | 59% – 129% | Tailored to people with bad credit |

| Approval Criteria | Income-based (not credit-score heavy) | More flexible than mainstream lenders |

Christmas loans for bad credit with guaranteed approval offer hope for those with credit problems. You can apply, knowing that your score won’t automatically result in rejection. The lenders focus on your current income and job stability instead of past issues.

- The approval rates run much higher than standard bank loans

- You receive quick decisions without days of anxious waiting

- The amounts available typically range from £300 to £2000

Direct Lender Short-Term Loans

Working directly with lenders saves you money on broker fees and commissions. Your application goes straight to the company that actually provides the funds. The direct approach cuts out intermediaries who might sell your details to multiple companies.

| Feature / Term | Typical Range (UK) | What It Means for You |

| Loan Amount | £100 – £2,500 | Borrow directly; no broker fees |

| Repayment Period | 1–12 months | Choose short or medium term |

| Representative APR | 49% – 250% | Depends on term length & affordability |

| Decision Time | Minutes – same day payout | Faster approvals & fewer delays |

Direct lenders often provide better customer service when questions or problems arise. You speak with the actual decision makers rather than message-passing intermediaries. The loan terms are clearer without the broker’s added complications or fees.

- The process avoids extra fees that brokers typically charge

- Your personal details stay with just one company instead of many

- The loan decisions usually come faster without broker delays

Buy Now Pay Later (BNPL)

BNPL options have grown hugely popular for spreading Christmas shopping costs. You can make purchases now and split payments across weeks or months. The service is now available at checkout on many online shopping sites. Your payment schedule gets clearly laid out before you complete any purchase.

| Feature / Term | Typical Range (UK) | What It Means for You |

| Spending Limit | £50 – £1,500 | Shop now without upfront payment |

| Repayment Structure | 3–6 instalments (0% interest) | No interest if paid on time |

| Fees / Cost | £0 – late fee if missed | Cheaper than short-term borrowing |

| Credit Impact | Soft checks (no score dip) | Low risk to your score if managed well |

The most significant advantage comes from the interest-free periods these services offer. You spread costs without paying extra as long as you make payments on time. The approval process happens instantly at checkout without separate loan applications.

- The spending limits increase over time with a good payment history

- You receive payment reminders before each due date via email or app

- The process works especially well for online gift shopping at major retailers

Conclusion

Several loan options are available for those who need extra money during December. Payday loans offer quick cash but often come with very high rates. Credit unions provide more reasonable terms, though with slower approval times.

High street banks offer personal loans with better rates for those with good credit. Online lenders have created more options in recent years for various credit scores.

Jessica Rodz is the Senior Content Writer at Cashfacts. She has a long career in the field of content writing and editing. Jessica has the expertise in the UK lending marketplace where she has worked with 7 different lending organisations and acquired many responsibilities from preparing loan deals and writing blogs for their websites.

At Cashfacts, Jessica is managing a team of experienced loan experts and doing a major contribution in guiding the loan seekers via well-researched blogs. She has done graduation in Business (Finance) and now currently doing research papers on the UK financial sector.