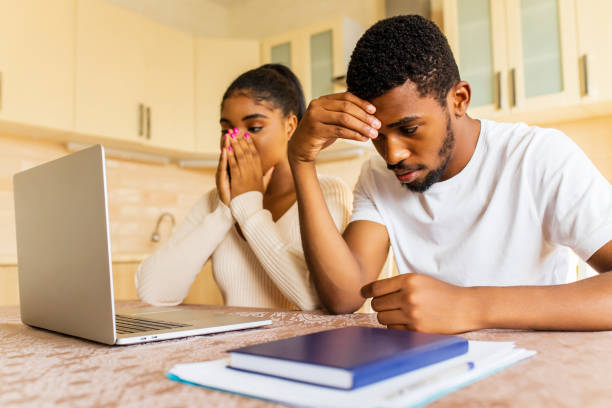

Young people in the United Kingdom have a lot of debt, which is not a secret. Many things have led to this problem, such as rising unemployment, rising living costs, high college costs, and a lack of financial literacy.

Here we will try to find out why young people have so much debt and what could be done about it. We will discuss how much debt young people have now and what could be done to fix this problem.

Why do young people in the UK have so much debt?

The United Kingdom has a problem with youth debt that has never been seen before. Many things have led to this problem, such as rising unemployment, rising living costs, high college costs, and a lack of financial literacy.

1. Unemployment

Even though the rate of unemployment as a whole is at a record low of 4.4%, the unemployment rate among young people has been at its highest level since records began in 1992. As a result, many young people can’t find steady jobs and have to go into debt to make ends meet.

Because there aren’t as many jobs for young people, it’s harder for them to support themselves and their families. This has made more young people depend on credit cards, overdrafts, and payday loans to pay for their living costs, which has led to a lot of debt that can’t be paid off.

2. Rates of interest going up

One of the main reasons there is so much debt right now is that borrowing money is getting more expensive. This is especially clear with payday loans for bad credit, which direct lenders first gave in the UK at much lower interest rates.

But as the cost of these loans goes up, it gets harder for people to pay them back on time and in full. This has made it so that people can’t pay back their debts and are getting deeper and deeper into debt.

The rising cost of borrowing is especially bad because it makes it harder for people to get out of debt. It is important to keep the cost of borrowing as low as possible so that people don’t take out loans they can’t pay back.

3. Expensive Tuition

Tuition expenses are becoming increasingly burdensome for young people. Many students need loans or credit cards to pay for school. Because of this, young people are getting more and more in debt as tuition costs keep going up and the amount of debt they have to pay back grows.

This debt crisis has become a big problem for young people, who already find it hard to keep track of their money and find stable jobs. Because of this, it’s hard for many young people to get out of debt and hard for them to make ends meet.

As tuition costs keep increasing and the amount of debt young people also, the situation worsens quickly. Obviously, more needs to be done to solve this problem and give young people the help they need to pay off their debts and live a stable financial life.

4. Financial ignorance

This causes many young people to make poor loan and credit card decisions. Young individuals often get into debt because they don’t consider the repercussions. Without a basic understanding of money, young people may quickly get into debt without realizing what’s happening.

With good financial education, young people can make smarter decisions about their money, which could help solve the problem of too much debt. Young people need financial education to learn how to handle their money well, which may be the key to keeping the debt problem from worsening.

Possible ways to solve the debt crisis

- Promoting Financial Education

One of the most important ways to solve this problem is to teach young people enough about money. This could be done by putting financial education programs in colleges and giving young people tools that will help them learn more about how to manage their money.

By teaching young people how important it is to know about money and giving them the tools to do so, we can ensure that they will succeed in the future.

- Less money for tuition

By lowering tuition rates, young people will be able to pay for their expenses without taking out loans or using credit cards. This will make it less likely for them to get into debt.

This is a good idea that could help a lot of people, especially college students, whose tuition payments are sometimes their biggest expense. If tuition prices went down, students would have more money to pay for things like housing, books, and food, and their total debt would go down.

- Help from the government

College loans may be the only way for students who are just becoming adults to pay for their education. If a student has bad credit, it might be hard for them to get a loan. Students with poor credit who have jobs and need to repay their student loans can get special loans.

One option for students with bad credit is to get payday loans. Students who might not be able to get standard loans can get these loans quickly and easily.

The application process for payday loans for students with bad credit is easy. Direct lenders in the UK give easy and quick approval, which is great for students who need money quickly.

Also, the terms for paying back the loan are flexible, so students can choose a plan that fits their budget. Payday loans for students with bad credit can help them get the money they need without all the trouble of a regular loan.

Conclusion

The fact that the UK’s debt is worsening is a clear cause for concern, and the government and the people need to do something about it. We need to ensure that people don’t get into debt and have the knowledge and tools they need to manage their money wisely.

At the same time, the government must help people struggling with debt and give them the tools they need to get back on their feet financially. We can all have a better financial future if we all work together to solve the growing debt problem.

Jessica Rodz is the Senior Content Writer at Cashfacts. She has a long career in the field of content writing and editing. Jessica has the expertise in the UK lending marketplace where she has worked with 7 different lending organisations and acquired many responsibilities from preparing loan deals and writing blogs for their websites.

At Cashfacts, Jessica is managing a team of experienced loan experts and doing a major contribution in guiding the loan seekers via well-researched blogs. She has done graduation in Business (Finance) and now currently doing research papers on the UK financial sector.