Everyday loans- A swift way to fund the unexpected!

Covering emergency expenses with the available money can sometimes be challenging. You must manage your daily expenses well. For that, you must keep some savings safe. If you fail, two options remain in the end - first, to sell personal belongings and second, to borrow the money.

Moreover, most individuals lack sufficient savings and earn lower incomes. Getting a quick loan in that case seems impossible. Here, CashFacts's Everyday loans may prove just the right solution. You can get the cash irrespective of your credit score. We help you overcome past credit scars and fund your current needs. Contact us for everyday loans in the UK marketplace, even with bad credit. You may qualify if you share the potential to pay the dues according to the agreement timeline.

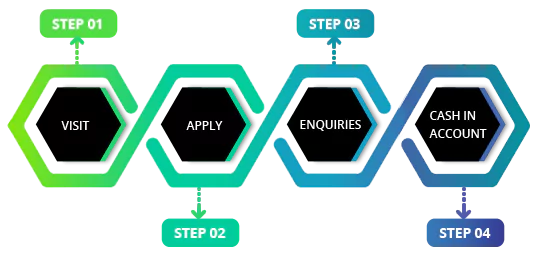

There is nothing better than applying for a loan at your own convenience. As these are small loans, you can pick your Smartphone and start applying for these text loans available 24/7.

We offer these loans on a same-day basis, and they have useful FEATURES that you, as a borrower, are entitled to avail. These are:

- You can avail anywhere £500-£5000 for your needs

- You can opt for your loan duration that matches to your repayment capacity

- The interest rates are flexible according to borrowers’ situations

- Fast decision based on income and affordability checks

- Explore the options of weekly or monthly repayments

- You can apply online safely with our encrypted payment channels

What do you mean by Everyday loans?

Everyday loans are an unsecured financial facility for short-term needs or emergencies. You can obtain a small amount to address urgent needs without going through a time-consuming loan process. Instead, these loans prioritise quick approval by focusing on affordability alone. If you have a regular income, balanced finances, and an authentic citizenship profile, you may qualify.

The interest rates on such loans remain competitive. It is because it does not require a guarantor or collateral to qualify. You can make this process easier by borrowing only an affordable amount. Fixed interest rates and terms ease the budgeting capability. Thus, individuals with regular and irregular incomes can repay accordingly. You must pay the dues within 12 months of the loan application and approval.

What are the Benefits and Risks of Everyday loans?

Yes, getting a loan for everyday needs without hassle is relaxing. It saves you from losing your precious assets or offending a guarantor. These flexible repayment loans in the UK prove beneficial if the income drops suddenly. However, you cannot ignore the risks associated with these loans. Here is the clear description of that:

| Parameters |

Benefits |

Risks |

| Risks |

Individuals with limited or bad credit history may qualify |

High-risk borrowers may face high interest rates and an increased repayment burden |

| Speed of access |

Quick approvals on these loans for critical emergencies ease the stress |

It may tempt borrowers to seek cash without reading the terms or researching the best rates. |

| Impact on credit score |

Repaying the instalments on time, as per the agreement, boosts your credit score. |

Missing payments, rollovers, and loan defaults affect your credit score significantly. You may struggle to meet other life goals, like a mortgage. |

| Credit Accessibility |

We conduct “soft credit checks in the UK” to determine the affordability. It does not affect the credit score. |

Basic affordability checks do not guarantee loan approval. It helps you understand the amount you may qualify for, depending on your finances. |

Thus, factor in such benefits and risks before applying for everyday loans in the UK from a direct lender like us. It will help you determine whether the loan is right for you. Also, we offer personalised assistance to deal with non-repayments.

How does an Everyday loan vary from other loans?

Yes, an everyday loan operates uniquely from a payday and a self-employed loan. It is essential for covering both planned and unplanned expenses, such as home repairs. Alternatively, payday loans are ideally used to cover any critical need before the "salary day". Similarly, loans for the self-employed in the UK are ideal for new business owners or freelancers who need cash to meet business expenses. Thus, you can clearly see the difference between the loans here. Let’s read in detail:

| Parameters |

Everyday loans |

Short-term loans |

Payday loans |

Self-employed loans |

| Meaning |

These loans are used for known expenses that you forget to budget for |

These are the unsecured loans used to meet any short-term or priority expenses. |

One may use a payday loan to fund any expense just before the salary day. Like, |

It is ideal for freelancers with irregular income. They may check one to cover any costs they encounter in the meantime. |

| When to use the loan? |

You can use it for needs like “a pending utility bill, home repairs, debt consolidation, etc. |

It is ideal for aspects like “buying a basketball kit for the upcoming match, repairing furniture. |

Most individuals consider this to pay any critical need before salary day, like “paying for a cash-on-delivery order” |

Self-employed people can use it for equipment purchase, inventory update, marketing or stationery purchase, and rent payments. |

| Loan amounts |

£500-£5000 |

£1000-£3000 |

£1000-£1500 |

£1000-£25000 |

| Specific features |

- Instant loan approvals

- No guarantor or collateral needed

- Same-day cash-out possibility

|

- Pay debt in equal and easy instalments

- The possibility of halting payments if you cannot pay

- Small repayment term

|

- Pay the money in a lump sum by the next payday

- High interest rates

- Continuous payments may improve credit rating

|

- Individuals with complete proofs and company registration may qualify

- Unsecured and secured options available

- Individuals with good personal and business credit scores may get cheap interest rates

|