Can I get a holiday loan with bad credit?

It is crucial to have a good credit history to qualify for a personal loan for travel purposes. Most lenders will not entertain your application if they find your credit report is not up to snuff.

Well, you do not need to be disappointed if that is the case as we offer bad credit finance.Only the basic eligibility criteria are required to qualify for these loans. These include:

- You have to be over 18+

- Must be residing permanently in the UK

- Holding an active and valid bank account

- Earning minimum income of £800 per month

We believe that a less-than-perfect credit rating must not come in your way to enjoy a dream tour. Interest rates for poor credit people will be slightly more than those with a stellar credit report. They could be between 8.99% and 18.95%, still lower than the market rates. You need to prove your affordability, and there will be a soft credit check to ensure a loan according to your repayment capacity. That mild credit score check does not impact your credit score. However, you should maintain a steady income, especially over the last 6 months.

If you want to secure a deal at more affordable interest rates, you will likely have to make either of the following arrangements:

- Secured Loans: You may secure your loan against a high-value asset provided you borrow over £5,000.

- Joint Loans: If you do not want to secure, you may enter into an agreement with a co-applicant with a good credit record.

- Holiday Loans with No Guarantor: You can arrange a guarantor if you have neither collateral nor co-applicant.

We make all possible efforts to provide travel loans for bad credit people at competitive interest rates. Keeping your financial safety and interest in mind, the borrowing limit is lower, up to £20,000.

Can unemployed people get holiday loans?

A lender rarely approves an application for a holiday loan when you are out of work. You can demonstrate your repaying capacity with a passive income source, yet you cannot qualify for these loans.

Unemployed loans have been designed to cover necessary expenses related to your trip when you are jobless. However, sometimes your trip can be tangled with urgent expenses.

For instance -

it is likely that you have already lost your job when your flight is due to take off. You may not have enough savings to pay for accommodation, food, and drink expenses. In such a scenario, you are eligible to qualify for emergency holiday loans for unemployed.

- As these loans aim at just funding necessary expenses, the lending amount will be small, not more than £5,000.

- You will have to show us pre-booked flight tickets and your employment’s last day, so we know you lost your job after booking a flight.

- The loan will be paid back in weekly instalments.

What fees apply to loans for holidays?

Fees generally decide whether you will be able to affordable personal loans for holiday or not. When choosing the best deal, you will have to look over lower fees and low-interest holiday loans in the bargain. The latter may vary by lenders, which is why a deal becomes expensive or affordable.

Our loan products are inexpensive not just because of attractive interest rates but because of the low fee structure.

| Fee Types |

Fee charged |

| Establishment fees |

£100 |

| Monthly fees |

Nil |

| Cancellation fees |

£150 |

| Early repayment fees |

Nil* |

| Late payment fees |

£18 |

| Hidden fees |

Nil |

*We will not charge early repayment fees if you notice us in advance. Doing so without keeping us in the loop will cost you 10% of the additional amount you are paying off.

What are the benefits and risks of fast holiday loans?

You may not be able to make a decision about whether you should borrow or set aside. This entirely depends on your financial situation. Of course, the latter seems to be a more favourable option when your budget does not allow it.

The following table points out some benefits and risks of fast holiday loans so you can make the right decision.

Benefits

- They are convenient to apply as you do not need collateral.

- Interest rates are fixed, so you will know the amount to pay every month. It makes them more manageable.

- You can pay before the due date without bearing any additional costs. However, you will have to inform us beforehand.

Risks

- They will likely involve a higher interest rate.

- If you are taking out a large amount of money, make sure you have carefully planned your budget for payments.

- Credit score may be damaged if you make a default. These loans involve hard credit inquiries that can worsen your credit rating if it is already in bad shape.

How can you help me when I am struggling with quick holiday loans?

Even though we provide quick holiday loans at the most competitive interest rates, you will likely find it hard to pay off the debt on time. The most common reason for it is fluctuating financial situation. You can lose your job, or any significant emergencies can crop up.

If you doubt that you may fall behind the due date, just tell us. We will certainly help you in the following ways:

- Payment holidays: We may offer you a payment holiday but only for a short period. The tenure will be decided after considering your current financial situation.

- Minimum monthly instalments: We may allow you to make minimum monthly payments, but interest will keep accruing on the outstanding balance.

- Restructuring of repayments: We will revise your repayment structure based on your latest financial condition.

How can CashFacts help secure a good deal?

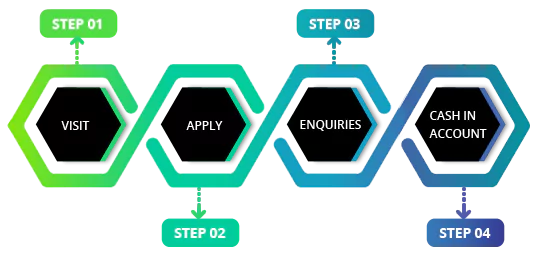

Various online lenders are out there claiming to provide the best travel loans. Still, you can get money at attractive terms from us. Here is how we provide you with a good deal that suits your budget:

- Since we deal 100% online, we can ensure fast approval on travel loans (subject to affordability)

- We carefully analyse your income statement.

- We restrict the borrowing for bad credit borrowers as they are expensive.

- We offer holiday loans with flexible repayments in the UK, no need to worry when your financial situation is not favourable.

- Our interest rates are lower than those charged by other lenders.

Looking to make a trip? Apply for loans for a holiday.