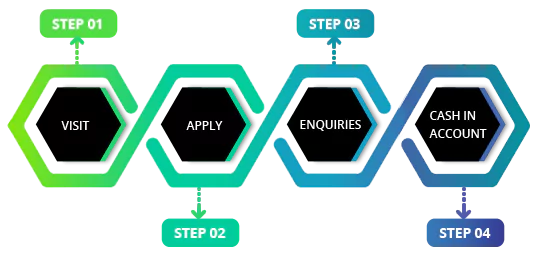

How fast can I obtain loans with no guarantor?

Here, the application process takes off seamlessly to ensure same-day payout. It is because of the precise steps that are totally different from the traditional process. Loans without a guarantor for bad credit people need you to fulfil a few quick steps excluding any documentation part.

Find out how to start with us without further ado.

Fetch the online form: A single click is enough to direct you to the application form. Just visit our website only. You should not get any hard copy of the form.

Adding details as enquired: The form will have dedicated fields enquiring about relevant information from your end. Not many fields will be there. You just have to put in a few vital details.

Go ahead with the correction: Often, people hurry up filling out the application seeing an opportunity like loans with no guarantor despite poor credit. They end up making mistakes. For this reason, reviewing and correcting errors is a vital step you must not miss.

Head to the final step: In the end, you need to submit the application. After that, we can get access to your application to do what is necessary for processing your request.

Wait for our response: The waiting period is not too long on this instant loan in the UK. Within 15 minutes, we can decide to approve same-day loans with no guarantor requirements. Everything will be on how suitable your application is.

How no credit check is possible on loans with no guarantors?

Loans with no credit check or guarantor mean hard checks are avoidable. The assessment of your affordability will make sure you can get loans without anyone else support. Here, you will face a soft version of the evaluation. We will only need confirmation that you are currently financially stable compared to the past.

You can have a huge advantage here, as none will enquire about your credit scores. This is the major difference when you assess soft vs hard credit checks. A soft enquiry does not affect your credit score. Therefore, you can obtain loans with bad credit and no guarantor without facing any restraint. These loans can in fact help you in better ways with additional features like:

-

Pledging security is not necessary

It is not that you will get relief from the guarantor factor only by applying here. No credit check loans need no guarantors and security also. You must not endanger your costly assets. The best alternative way to borrow money is at your disposal now.

This feature also ensures tenants and non-homeowners do not remain isolated. They can now take out the money in the hour of crisis despite lacking assets. All in all, it is the most comforting option for someone insecure about their asset possession.

-

No burden of upfront fees

There is no need to pay attention to brokers when you deal with us. No guarantor loans from a direct lender will keep away brokers and brokerage fees. In addition, we will not charge anything other than interest fees.

Rest assured, to face no surprise fees. However, there will be a late payment fee but no early repayment fee. Our fee structure defines how we charge money and where we can charge extra. It will only happen when you do not repay on time.

Why approach CashFacts for no guarantor loans with bad credit?

You have come to us after realising that bad credit loans with no guarantor are needed. Nevertheless, you will need solid reasons to stay here for some time and avail of our services. We also know that ensuring your smooth borrowing experience is our responsibility. We are taking care of it with honesty. At the same time, beating the competition is also necessary. Managing both is tricky, but we are more dutiful towards our borrowers. For this reason, we present a loan with no guarantor and no credit check with add-on facilities like:

Trustworthy platform: The application form requires some confidential information. You can share them without any fear, as safety features are top-notch in our case. None can misuse or steal your information from our platform.

Friendly support: Our website is open to access round the clock. You can chat with us or mail us anytime, as we are available all days of the week. You can make the most out of our services every time.

Responsible lending: We are a responsible lender in the UK. Our motto is to do the necessary things to allow borrowers to get money with the least effort. Likewise, we will not tolerate any unfair practices here also.