What defines loans for students?

A funding arrangement that will exclusively address the cost of education near or far from home defines loans for students in the UK. When you attend the University for higher studies, you must take care of diverse expenses. It could be for travel, tuition, books or even accommodation purposes.

The different options available here also allow you to get financial help to complete vocational training. Private student loans are one of our special categories wherein you can opt for loans while studying and doing a job simultaneously. These loans come into use when you want to rejoin the college.

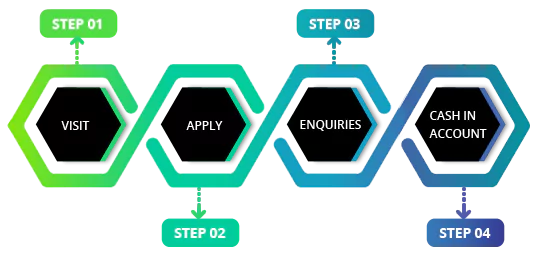

This loan provision facilitates easy payment of fees to the college directly. It means you will not get the money in your account. If this provision does not suit you, consider applying for instant loans for students as unemployed. Why? It is because you can get these loans straightaway in your bank account.

Alternatives are available here at Cashfacts regarding the best student loans in the UK. The reason behind keeping a wide variety of loan sub-categories is to suffice the diverse requirements of loan applicants. Some of you may need loans for petty educational purposes. We can arrange small loans for students in a seamless way.

Can I get loans for students with bad credit?

Low credit happens because of skipped payments on previous credit options. Get a chance to avail of loans for students with bad credit, as they can be a perfect financial fix even when poor credit tags are a big trouble in your life.

Soft credit checks only with no hard footprint: As credit scores are not concerning to us, we do not conduct a hard assessment of your credit profile. However, determining your affordability is our first and foremost responsibility before making any decision.

Therefore, we conduct basic checks, like understanding your income and monthly payments, before approval. It helps us determine whether you can repay the loan. It does not impact your credit score and helps you get affordable student loans in the UK marketplace.

As a student, you will have some responsibilities when managing student loans for bad credit scenarios.

- Use money gradually: You might feel like using the same all at once when you get loans in your bank account. As a result, you might tend to spend more. It will prevent you from utilising loans for the right purposes. Fix a weekly or monthly budget and pursue it for smooth handling of payouts with loans.

-

Recognise your repayment capability: Suppose you are looking for payday loans. You must be aware of its repayment conditions and other criteria. If you are not prepared to pay back within a short duration, these loans might not be an apt alternative.

Let’s understand how repayment structure changes the costs and interest liabilities. Here is a representative example of Student loans:

Representative example: If you borrow 1000 pounds at an APR of 7.0%, here is how the costs may vary according to the repayment terms:

| Terms |

Monthly repayment(in pounds) |

Total repayment(in pounds) |

Total interest costs(in pounds) |

| 6 months |

171.27 |

1027.64 |

27.64 |

| 12 months |

86.53 |

1038.64 |

38.36 |

| 36 months |

30.88 |

1,111.68 |

111.68 |

So, borrowing money for a short period is cheaper than borrowing for a long term. You pay just £27.64 by borrowing for 6 months, over £111.68 for 36 months. You can opt for short-term student loans in the UK if you need to cover a small expense and avoid lengthy interest payments. However, decide the proper repayment term as per your income, savings, monthly bills, and budget.