According to PropertyWealth research, “The UK property market is resilient with the forecast predicting the 3% hike in property prices across the country.” The primary reasons are reduced employment, slight economic growth, and wage improvement.

Such aspects may boost house sales in North West England and the Midlands particularly. These are high-potential areas for growth.

Does an increase in house sales imply an increase in mortgage rates?

While property prices are rising, mortgage rates remain low. According to the Guardian-

“A 5-year fixed rate mortgage costs 4.86% on average compared to 6.11% in July 2023.”

Britain is facing a bidding war against the high street mortgage providers.

The reason for improving their mortgage rates is the anticipation of the Bank of England reducing the interest rates. The good news is that

“The Bank of England reduced bank rates by 0.25% in March 2024. The bank rate is now 5% from 5.25% in 2023.”

It may further go down, making mortgages incredibly affordable.

When mortgages get too affordable, property prices rise. It becomes challenging individuals to buy property before selling the existing one.

But what if you want to buy a property without selling the owned one?

Here, bridging loans enter the scenario.

What are bridging loans?

A bridging loan is a short-term but secured loan that helps a person finance a property purchase without selling the existing one. Individuals can use it to bridge finance between critical events like winning an auctioned property and funding the costs.

Usually, auctions require the winner to pay 10% of the property cost to confirm the purchase. One can use the loan to pay the property price and clear the loan dues with the property sale.

Facilities like bridging loans in the UK market are ideal for property brokers, buy-to-let dealers, and commercial businesses seeking instant finance. You can get up to £25m to finance the purchase. However, you must provide a self-owned property as collateral to get the loan. The providers calculate the total loan amount you qualify for based on the collateral value.

Why would you use a loan to bridge the property purchase?

Apart from auction purchases, one may use the loan for other purposes. Some buy-to-let companies use it to renovate the property. Using existing property as collateral or 2nd charge mortgage allows more flexibility than mortgages. A second charge mortgage is usually secured against your home. You can use it if you need more funds with an outstanding mortgage on the property.

Let’s analyse what you can use a bridging finance for:

| Meeting transaction deadlines Traditional mortgage providers take longer to confirm and approve the loan. It makes it challenging to meet the property purchase deadline. Bridging finance provides the funds within 24 business hours or the next working day. | Bridge instant business cash requirements Businesses can use it to finance critical requirements like- expansion, releasing a massive funding amount, or renovating the property. It eliminates waiting for the client’s payments. |

| Landlords looking to expand Building a healthy portfolio is critical to fetch instant and affordable loans. Most landlords depend on rental payments to purchase properties. Bridging finance helps expand without dependency. | Purchase inhabitable or non-mortgageable Property Property investors and developers seek unhabitable property to re-construct and sell. It is not possible to get a usual mortgage on unhabitable properties. Here, one can finance the need with a bridging loan. |

Who qualifies for a bridging loan?

Each loan provider holds a specific list of criteria for approving the loan. You may qualify for the loan by meeting the below common criteria. As a regulated bridging finance provider, we want the borrower to be sure about the hefty sum. Hence, the qualifying criteria sums up everything that we need to know. Here is how you can qualify:

| Parameters | Terms |

| The maximum amount you can get | 75%LTV for residential and commercial properties |

| Loan Term | 1-12 months (can exceed 14 months to pay comfortably) |

| Minimum loan size | £50000 |

| Maximum loan size | £25m |

| Minimum interest | 0.45% |

| Interest calculation pattern | Rolled or Retained |

| Who can apply | Individual, sole trader, Limited companies |

| Security type | 1st and 2nd charge mortgage |

| Funding for building types | New builds, refurbished properties, unacquainted properties. |

| Planning permissions | Depends on the individual circumstances and case |

Important terms to know

The above table explains the criteria for getting bridging finance. However, if you want to know some terms in detail, read ahead:

| Terms | Explanation |

| Loan-to-value ratio | It is an assessment that calculates the value of the property against the amount you need as a loan. A higher LTV ratio of 80% implies you get 80% of the property value as a loan |

| Rolled interest rates | A rolled-up interest rate is a rate where an individual does not pay interest quarterly or annually. Instead, the provider adds it to the principal amount. He adds the interest monthly and adds to the total balance. |

| Retained interest rates | It is an interest rate type favourable for property development finance. The provider adds interest to the prime agreement. Instead of making monthly payments. |

| First charge mortgage | The first charge mortgage covers the primary costs of the property purchase. A second charge mortgage is a second loan secured against the same property. The latter one is expensive as it entails more risk. |

What role does LTV play in bridging loan approval?

A bridging loan helps one fix the gap between critical finance needs and cash availability. It helps businesses and individuals finance property purchases without waiting. The borrowers use the equity in the existing fresh or mortgaged commercial or residential property.

They use it as collateral to finance the purchase of the new property. The provider analyses the property value by calculating the loan-to-value ratio. Low LTVs are favourable for loan providers but require borrowers to provide a high down payment. Here is the formula to calculate loan to value ratio:

LTV ratio = MA/APV

Where MA= Mortgage amount

APV = Appraised Property Value

You can calculate the LTV ratio by dividing the mortgage amount by the appraised property value. You must express it in percentage. For example:

If your property’s appraised value is £100000 and you make a £10000 down payment, you can borrow £90000. It concludes that you get 90% of the property’s value as a borrowing amount.

Note: Down payment amount, sales price, and appraised property value define the LTV ratio. You can reduce your liabilities with a high down payment.

Additionally, the LTV ratio on 2nd charge mortgages is low compared to 1st charge mortgages. It means you get less than 90% of the property value on the loan.

Here is what happens after LTV calculation.

How does bridging finance work?

An LTV is just the beginning of the bridging finance sanction. Here are other aspects that decide the loan approval. Below is the step-wise process of how the loan works:

- Affordability analysis

You must have strong credit and finances to get bridging loans. Income is less important as you do not need to make monthly interest payments on these loans. Moreover, the equity in the collateralised property covers that for you. However, you will be asked to provide proof of basic income like tax returns, payslips, and bank statements for surety.

2. Provide details regarding the new property

The company may ask you to provide the details regarding the property type to purchase. For example, if you want to purchase a new property for an office, provide details like- location, legal case( if any), the reasons to purchase, etc. Additionally, you must have relevant proof of the purchase price.

3. Get an agreement stating the terms

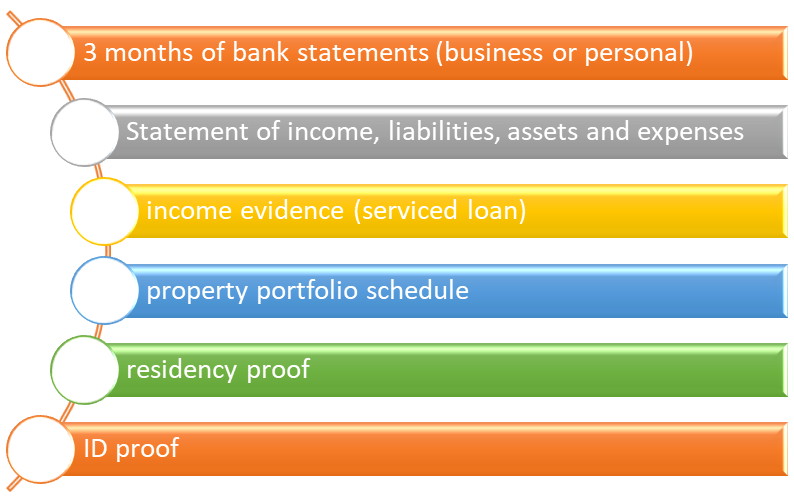

A responsible company issues an agreement with the terms of the proposed finance. It lists the document requirements and other details to confirm the loan. Generally, you must provide,

4. You get a valuation report

A valuation report helps accurately estimate the borrower’s collateralised property. It includes two sections—property appraisal and statement of opinion.

| Property Appraisal | Statement of opinion |

| It evaluates the expected property value until the loan term ends. The section involves physical property inspection, construction analysis, premises analysis and other features. | It is the summary of the surveyor’s opinion. It includes opinions regarding the security offered and other factors. |

The provider sends a copy of the valuation report to your solicitor. He helps you with further term explanation. You may hire a solicitor for better clarity. If you lack funds, check installment loans for bad credit scores from direct lenders only, especially with no guarantor requirement. A short-term loan without a guarantor helps you counter expenses individually. You can finance the solicitor costs and pay in easy instalments. The expert reduces the hassle and manages every legality on your behalf.

5. Provide loan confirmation

After knowing both the ins and outs, send your confirmation. You must pay the dues according to the agreed plan. Usually, you must pay the interest payments and outstanding charges. The provider may secure the rest of the funds with the sale of the property. Thus, you must have an exit strategy that states the loan repayment plan. It may help you get instant finance.

Bottom line

Bridging loans are flexible and short-term loans to fix expensive property purchases. You can consider it if you can repay the amount comfortably later. You can check open or close bridging loans accordingly. The former lacks a fixed repayment structure. Choose according to your finances. Later, you can repay the loan with the property sale.

Jessica Rodz is the Senior Content Writer at Cashfacts. She has a long career in the field of content writing and editing. Jessica has the expertise in the UK lending marketplace where she has worked with 7 different lending organisations and acquired many responsibilities from preparing loan deals and writing blogs for their websites.

At Cashfacts, Jessica is managing a team of experienced loan experts and doing a major contribution in guiding the loan seekers via well-researched blogs. She has done graduation in Business (Finance) and now currently doing research papers on the UK financial sector.